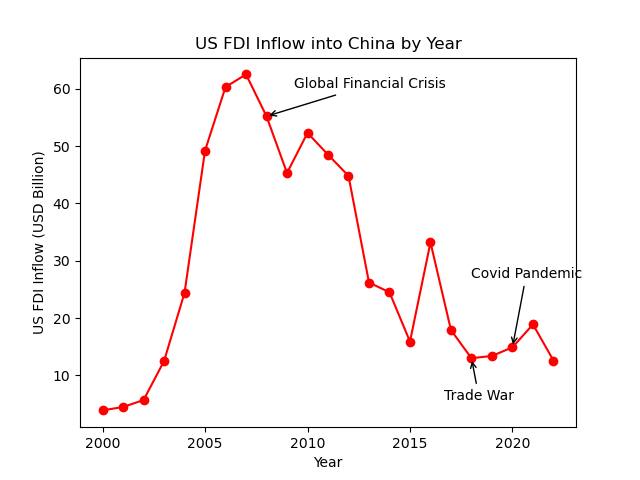

The Question: How far does the recent decline of US FDI (Foreign Direct Investment) into China, play a role in China getting more insecure and expanding its global reach of power.

The World and all countries alike have been increasingly more susceptible to events and developments in the geo-political theatre. It is not surprising that the world’s top two economic and military superpowers play a pivotal role in this theatre of events.

In the recent past, both the United States of American and the People’s Republic of China have increasingly been locking horns on multiple fronts. Therefore, it is an interesting field of research to delve into analyze the dynamic between these two nations on any particular front.

Analyzing US Foreign Direct Investment into China

What is Foreign Direct Investment?

Foreign Direct Investment (FDI) refers to an investment made by a company or individual in one country in business interests in another country, in the form of either establishing business operations or acquiring business assets in the other country.

FDI typically involves a long-term relationship between the investor and the foreign company or asset being invested in. It often includes the transfer of resources such as capital, technology, managerial skills, and expertise.

FDI plays a significant role in the global economy, as it can stimulate economic growth, create jobs, transfer technology and knowledge, and enhance trade between countries. Governments often try to attract FDI through various incentives and policies, as it can bring in additional capital and contribute to the development of infrastructure and industries in their countries.

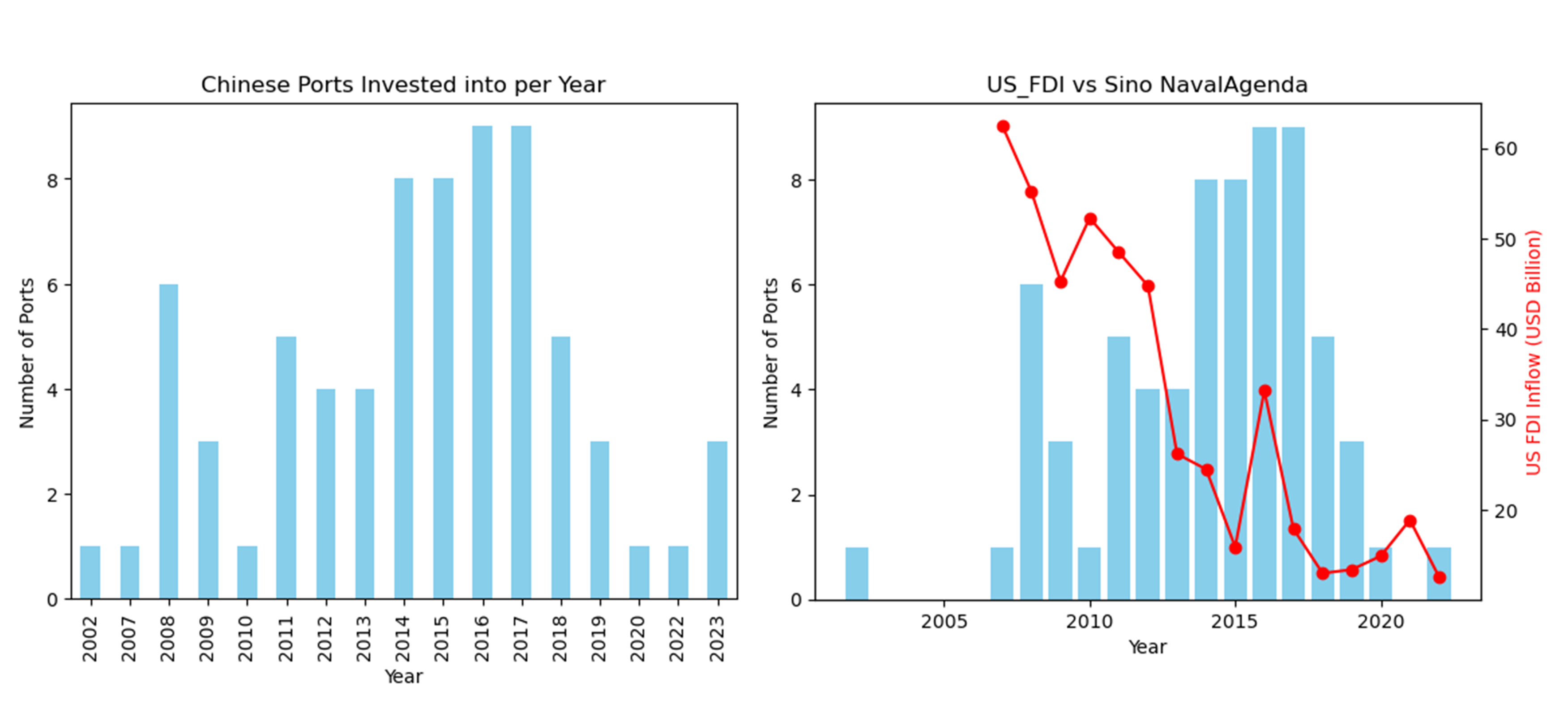

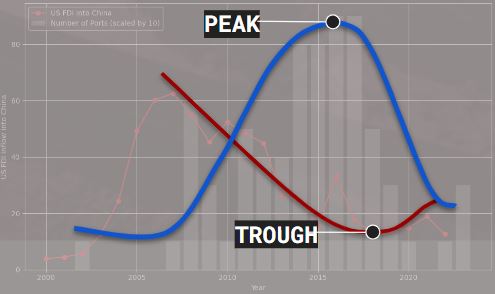

Chinese Ports invested into by Year

Why are ports important in this scenario?

Investments into ports around the world are important from China’s perspective for several reasons:

- Trade Facilitation: China is a major global trading nation, and its economy heavily depends on international trade. Investing in ports around the world allows China to facilitate its trade by ensuring efficient transportation of goods to and from its shores. Ports serve as crucial nodes in the global supply chain, and having control or influence over strategic ports enables China to better manage its trade flows.

- Strategic Access: Ports provide strategic access to key regions and markets. By investing in ports, China can secure access to key maritime routes and enhance its geopolitical influence. Control over strategic ports can also serve China’s military and security interests by providing bases or facilities for naval operations, as you mentioned.

- Belt and Road Initiative (BRI): China’s Belt and Road Initiative is a massive infrastructure and economic development project aimed at connecting China with Europe, Asia, Africa, and beyond through a network of roads, railways, ports, and other infrastructure projects. Investing in ports is a key component of the BRI, as they serve as vital hubs for maritime trade and transportation.

- Economic Expansion and Investment: Investing in ports allows China to expand its economic footprint globally. It provides opportunities for Chinese companies to invest in port operations, infrastructure development, and related industries in other countries. This not only promotes economic growth and development in those countries but also benefits Chinese companies by providing access to new markets and business opportunities.

- Energy Security: Many of the ports China invests in are located in regions rich in natural resources, such as oil and gas. Securing access to these ports helps China ensure a stable supply of energy resources to fuel its growing economy.

Overall, investments in ports around the world align with China’s broader economic, strategic, and geopolitical objectives, enabling it to enhance its global influence, support economic growth, and secure access to key resources and markets.

Why was 2008 a significant year?

The drop in U.S. Foreign Direct Investment (FDI) into China after 2008 can be attributed to several factors, and the global financial crisis of 2008 played a significant role in shaping investment trends during that time. Here are some reasons why 2008 was relevant and important in this context:

- Global Financial Crisis: The financial crisis of 2008, triggered by the collapse of Lehman Brothers and the subsequent credit crunch, had far-reaching consequences for the global economy. It led to a severe economic downturn, with many countries experiencing recession and financial instability. As a result, investors became more cautious and risk-averse, leading to a decline in FDI flows across various countries, including China.

- Impact on Multinational Companies: Many multinational companies based in the United States faced financial challenges during the crisis, including liquidity issues, declining revenues, and tighter credit conditions. This impacted their ability and willingness to invest abroad, including in China. Companies often prioritize investments in their home markets or focus on preserving capital during times of economic uncertainty.

- China’s Economic Slowdown: While China weathered the global financial crisis relatively well compared to many other countries, it still experienced an economic slowdown. Chinese exports declined, manufacturing activity slowed, and there were concerns about overcapacity in certain industries. These factors may have reduced the attractiveness of China as an investment destination for U.S. companies at the time.

- Changing Business Environment in China: The post-2008 period also saw changes in the business environment in China, including shifts in government policies, regulatory changes, and increasing competition from domestic firms. These factors could have influenced investment decisions by U.S. companies, causing some to reassess their strategies or delay expansion plans in China.

- Rising Costs in China: Another factor that may have contributed to the decline in U.S. FDI into China after 2008 is the rising costs of labor, land, and other inputs in China. As the Chinese economy developed and wages increased, some companies began to explore alternative manufacturing and investment destinations with lower costs, such as countries in Southeast Asia.

Overall, the global financial crisis of 2008 and its aftermath significantly impacted investment flows between the United States and China, leading to a decline in U.S. FDI into China as investors navigated the challenging economic environment and changing dynamics in both countries.

Financing

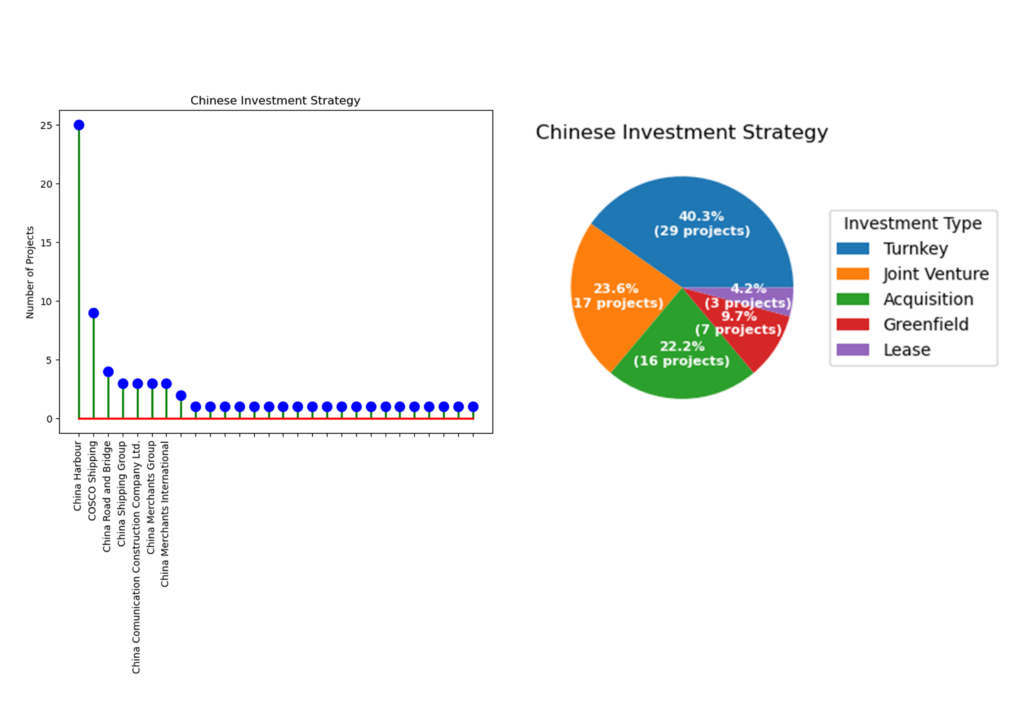

This dataset shows the main contributors to the expansion in the Chinese Global ports network, and the type of finance model employed to complete the projects. The China Harbour Company seems to have by far the largest share in the execution of these megaprojects. The finance model chart also shows us that the largest proportion of investments are done of a turnkey basis.

Turnkey projects refer to contracts in which a project is delivered to the buyer in a fully operational state. The term “turnkey” implies that the buyer just needs to “turn the key” to start using the completed project. In other words, the seller or contractor is responsible for completing the entire project, including design, construction, installation, testing, and commissioning, and delivering it to the buyer ready for immediate use.

Spatializing the Data

The benefit of spatializing tis data is that you get a clear idea of the sheer number of ports and military bases that each of these two countries possess.

Looking at the US military dataset, it is a fair conclusion to call the USA, ;The World’s Police’ in a sense, just because of the volume of military infrastructure they have scattered around the globe.

These maps can help in;

- Visual Representation: Mapping the ports and military bases provides a visual representation of their locations, allowing stakeholders to quickly grasp the geographic distribution and density of these strategic assets. This visual representation can aid in understanding spatial relationships and patterns that may not be immediately apparent from tabular data alone.

- Strategic Analysis: By overlaying the locations of ports and military bases on a map, analysts can conduct spatial analysis to identify strategic trends, such as concentrations of assets in particular regions or proximity to key geopolitical hotspots. This analysis can inform strategic planning, risk assessment, and decision-making processes.

- Geospatial Intelligence: Spatializing the dataset enables the integration of geospatial intelligence (GEOINT) into security and defense analyses. By visualizing the spatial relationships between ports, military bases, and other relevant factors such as terrain, transportation networks, and population centers, analysts can gain insights into potential vulnerabilities, threats, and opportunities.

- Operational Planning: Military planners and logistics professionals can use mapped datasets to support operational planning and deployment decisions. Understanding the geographic distribution of ports and military bases can help optimize supply chains, transportation routes, and deployment strategies, improving operational efficiency and effectiveness.

- Policy Formulation: Policymakers can utilize mapped datasets to inform policy formulation related to national security, defense posture, and foreign relations. Mapping the locations of ports and military bases in relation to geopolitical dynamics, international waters, and disputed territories can support evidence-based policy decisions and diplomatic negotiations.

- Communication and Collaboration: Maps provide a common visual language that facilitates communication and collaboration among stakeholders. By spatializing the dataset, information can be conveyed more effectively to diverse audiences, including policymakers, military leaders, diplomats, and the public, fostering greater understanding and consensus-building.

Overall, spatializing the dataset of ports and military bases on a map enhances situational awareness, supports strategic analysis and decision-making, and facilitates communication and collaboration in security and defense contexts.

Chinese Ports 2000-2015 Chinese Ports 2015-2023 USA Military Bases 2020

Mapping Areas of Influence

It is important to understand the regions of control that these points create for each of the countries respectively. This is important due to a variety of factors. Namely;

- Strategic Positioning and Resource Access: Control over key regions allows for strategic positioning of military forces and access to vital resources, enhancing readiness and supporting economic and security interests.

- Influence, Deterrence, and Geopolitical Dominance: Military control over strategic regions strengthens influence, deters aggression, and contributes to geopolitical dominance, shaping global security dynamics and diplomatic relations.

- Alliances, Partnerships, and Intelligence: Regions of control serve as focal points for alliances, partnerships, and intelligence activities, facilitating cooperation, information sharing, and collective responses to security challenges on the global stage.

Conclusions

Whilst there are numerous factors that would play into the conditions of the expansion of Chinese ports globally. This study shows us the layers behind the correlation between these two factors. There exists a clear correlation!

China has a stronghold of the areas in the Northern Africa and the Middle East, whilst the USA has an overlapping area of influence in the same area, it also has a hot density of bases in Central America and the Japanese islands.

SOURCES: