‘The project envisions the use of novel data collection strategies for the purpose of increasing access to formal credit for MSMEs in the F&B Space.

Across the globe, cities face a pivotal challenge: unlocking the potential of their micro, small, and medium enterprises (MSMEs) to drive both urban transformation and national economic growth. These enterprises, often comprising over 90% of businesses in developing economies, act as the backbone of urban economies, creating jobs, enhancing local supply chains, and fostering innovation. However, their influence extends beyond economic metrics.

The World Bank emphasizes the importance of cities and its enterprises achieving creditworthiness as a foundation for unlocking long-term private investments in infrastructure projects. “Supporting cities on the path to creditworthiness is the crucial first step in unlocking larger, longer-term investments,” the institution notes. By improving credit systems and leveraging urban data from smart city technologies, cities can enhance governance, provide essential services, and attract investments that foster sustainable growth.

The intersection of financial innovation, urban governance, and smart city technology could be the key to addressing credit gaps while paving the way for robust urban development. The question remains: How can we empower cities and MSMEs alike to leverage this data towards equitable financial access and sustainable urban development outcomes?

Understanding the ‘Pain-Point!’

Tackling the Problem

LEVERAGING PHYSICAL INFRASTRUCTURE & COMPUTER VISON TO CREATE A COMPOSITE SCORING METRIC TO SUPPLEMENT CREDIT SCORING FOR MICRO,MEDIUM & SMALL ENTERPRISES (MSMEs) IN THE F&B SPACE.

KEEPING IN MIND CONTEXT

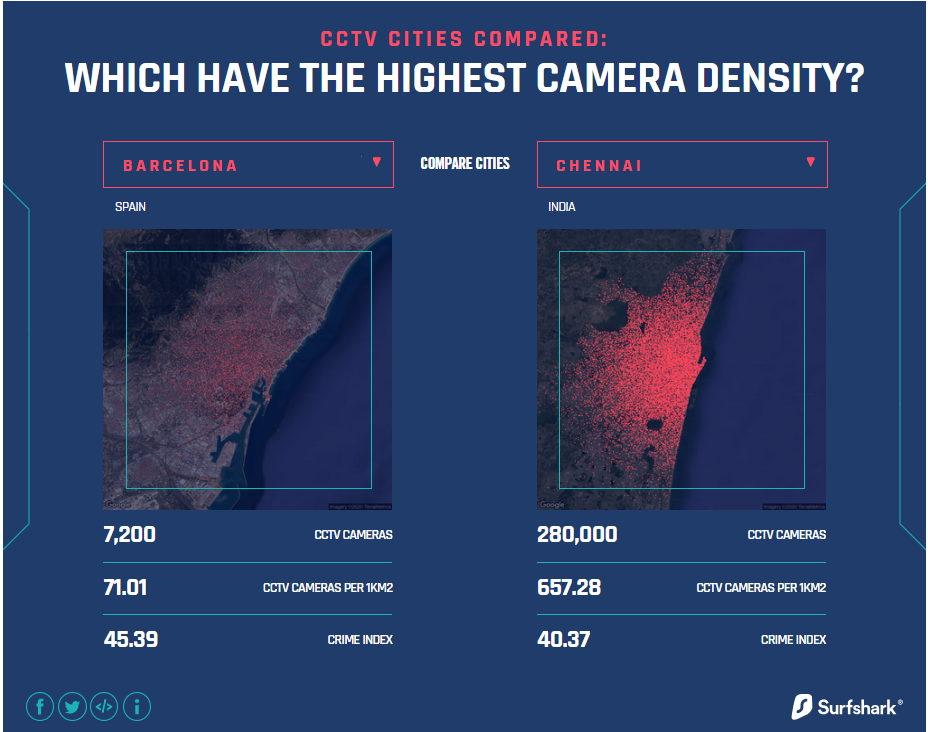

We visualized the implementation of the project would happen in the geographical context of a southern state capital in India. Namely, the city of Chennai in the state of Tamil Nadu.

Chennai is a host to more than 8 million people and is the economic capital of the state that is the second largest contributor to the nation’s GDP. This multiplied by the fact that it is the city with the highest camera density in the world, is something that could certainly be leveraged.

WHY ONLY THE F&B (Food & Beverage) INDUSTRY?

The F&B Industry is one that is extremely dependent on geo-location. This implies that there are certain physical factors of the urban context that will play a role in its success as a venture or not. This also plays into the theme that Indian cities have a plethora of food and dining options and it affects people across different economic strata.

UNDERSTANDING MARKET SIZE & PRODUCT VALIDATION

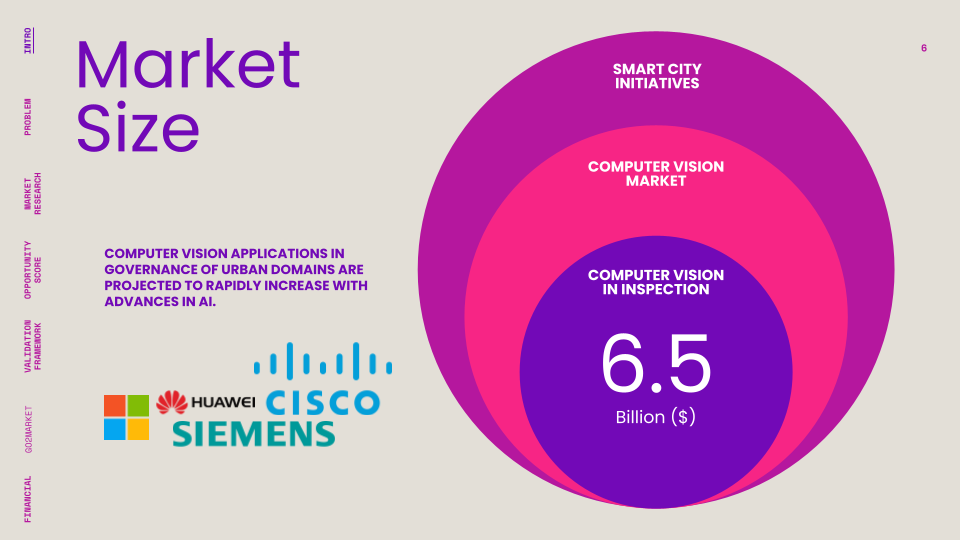

MARKET SIZE

- The Global Smart Cities Initiatives Budget has been estimated to around $5.2 Trillion (USD)

- The Overall Computer Vision Market showed up to an estimated $26 Billion (USD)

- This particular use case for the technology falls under the category of ‘INSPECTION’ under Computer Vision Technologies & Infrastructure. This is estimated at $6.5 Billion (USD) mark

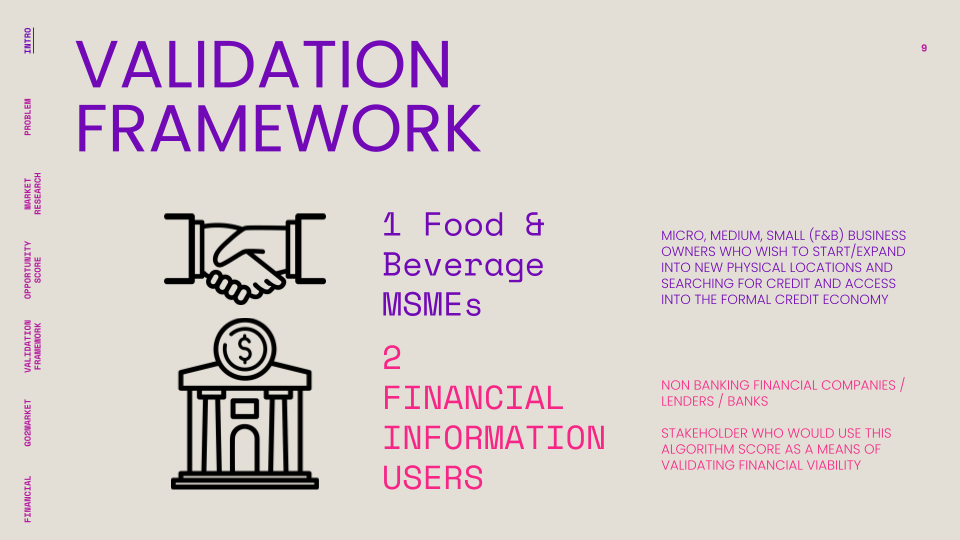

VALIDATION FRAMEWORK

The 2 target customers who would use the product are on different stages of the Innovation curve, therefor the validation strategy might have to differ a little bit.

- The FINANCIAL INFORMATION USERS (Banks/NBFCs) would be targeted by producing a valid algorithmically correct prototype that would demonstrate the potential of the technology for onboarding customers in the F&B Industry that were previously Credit Invisible/Credit-Visible Non-Lendable. Following which a LETTER OF INTENT would need to be produced to successfully validate the application.

- The F&B MSMEs would be targeted in a different way, through the means of creating a functional landing page with the ability for them to act and show interest in the service.

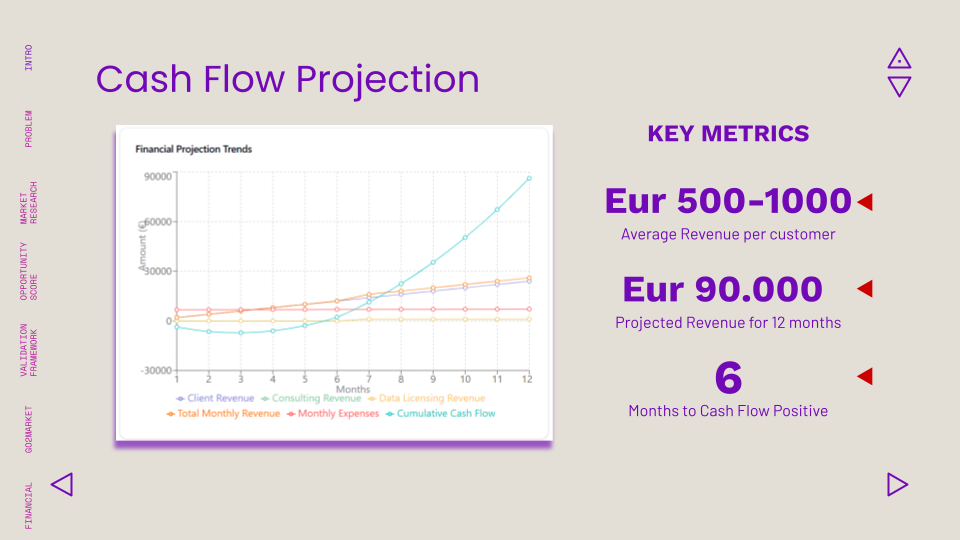

FINANCIAL PROJECTIONS

Criteria considered when making the cash flow projection;

- Revenue Projections

- Operational Costs

- Customer Payment Terms

- Revenue Streams

- A 12 month time horizon

For a pre-seed startup, assessing a cash flow projection is critical because it provides a roadmap for managing financial resources effectively and ensures the venture remains viable during its early stages. Cash flow projections help in several ways:

- Understanding Financial Viability:

- A projection gives an overview of whether the startup can sustain its operations, pay its bills, and manage unexpected expenses in the short term.

- Securing Investments:

- Investors assess the cash flow projections to determine the startup’s potential for profitability and its ability to provide returns on their investments.

- Identifying Funding Needs:

- By forecasting cash inflows and outflows, startups can identify when they might need additional capital and how much to request during funding rounds.

- Strategic Decision-Making:

- Cash flow projections help founders prioritize spending, allocate resources efficiently, and time key business activities such as product launches or hiring.

- Building Credibility:

- A well-structured projection demonstrates to stakeholders that the founders have a clear understanding of their business finances and market conditions.

RESPONSIBILITY & IMPACT

Leveraging technology to create societal impact is not just an opportunity—it is a responsibility. In the context of micro, small, and medium enterprises (MSMEs), empowering this backbone of urban economies through innovative platforms can drive sustainable development. By harnessing advanced data capture methods, such as IoT devices and geospatial tools, governments and private entities can build inclusive credit systems that provide visibility and access for underserved businesses.

Empowering MSMEs with access to tailored credit solutions, real-time insights, and collaborative networks fosters economic growth and strengthens the social fabric of communities. The ripple effect of this empowerment transforms not just the businesses but the cities they thrive in, creating equitable opportunities for all.