Clustering advanced industries to facilitate technology transfer in the Barcelona metropolitan region

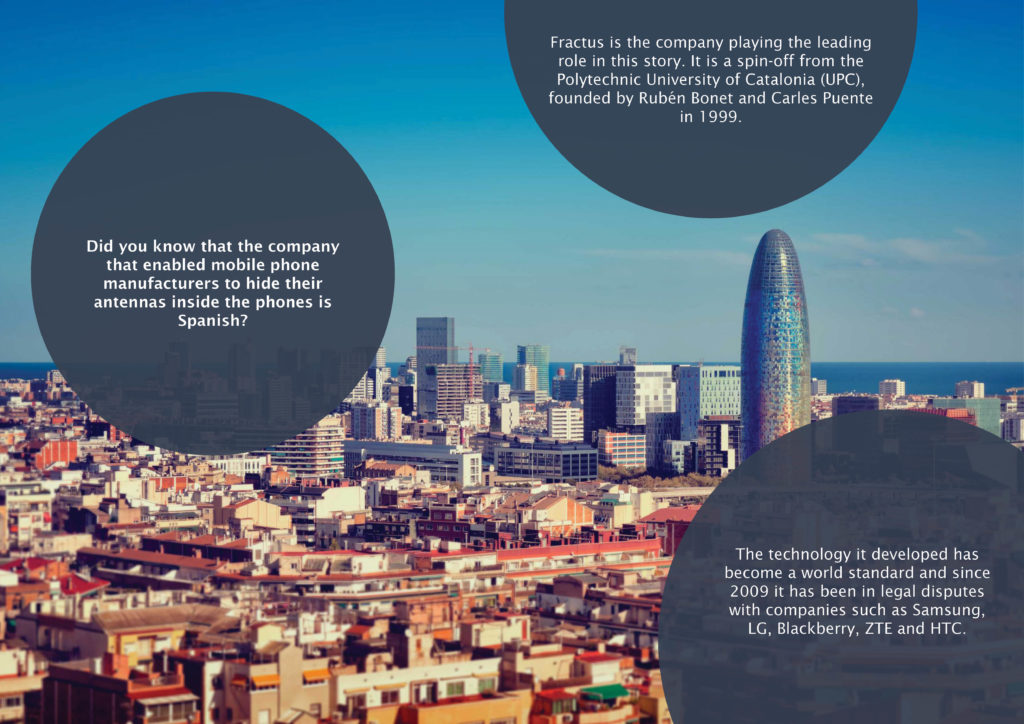

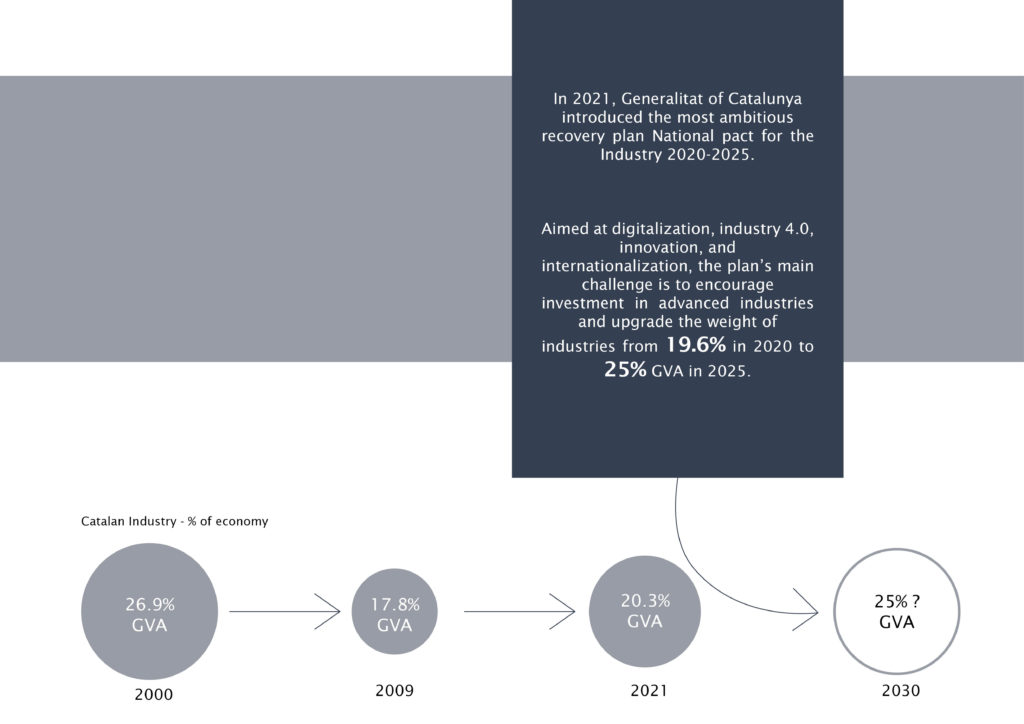

Spain has been at the forefront of pioneering research and innovation that have led to significant contributions to the world of technology.

Technology Transfer

Technology transfer from research to market seems like a straight-forward and linear process, but such is not the case.

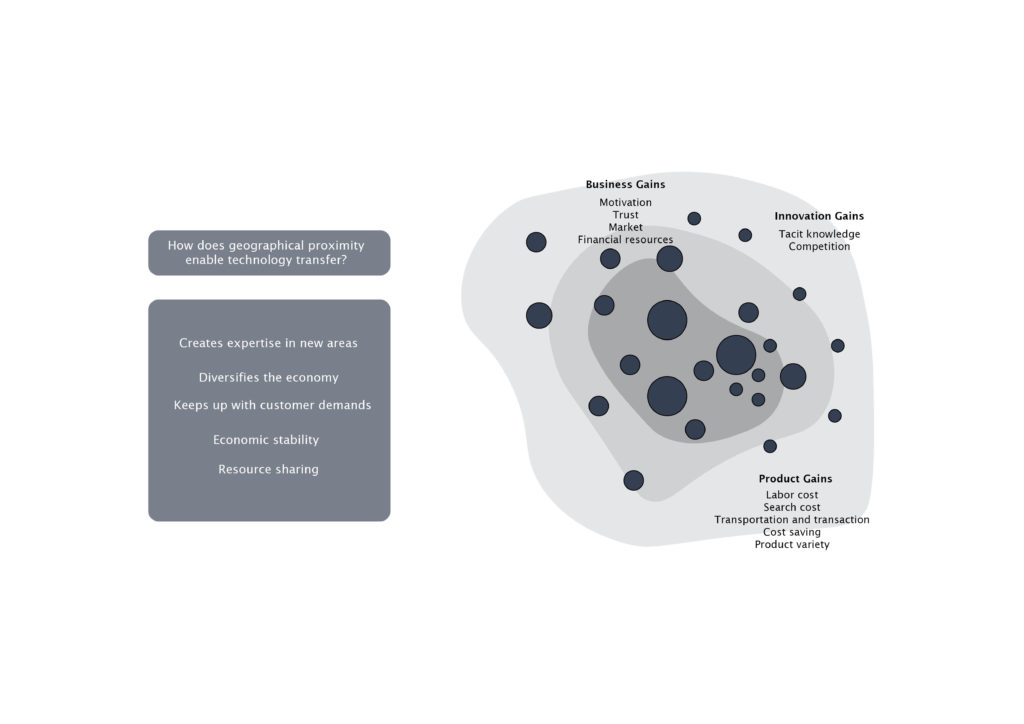

And we were posed with this question

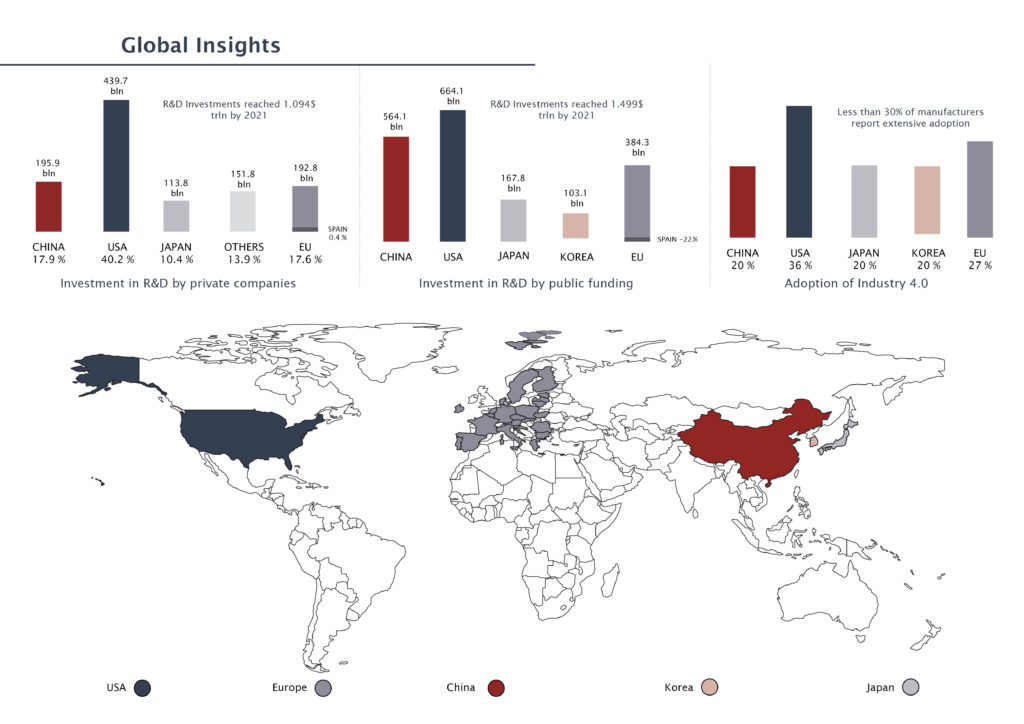

We started by looking into some global trends in the R&D sectors and the advent of Industry 4.0, which revealed the immense potential of Europe when compared to the rest of the world.

In Spain, the gross internal expenditure on R&D is lower than the average level of Europe. A target set by EU anticipated investment in R&D to account for 2% of GDP in Spain and currently it ranks 17th in the R&D – GDP ratio.

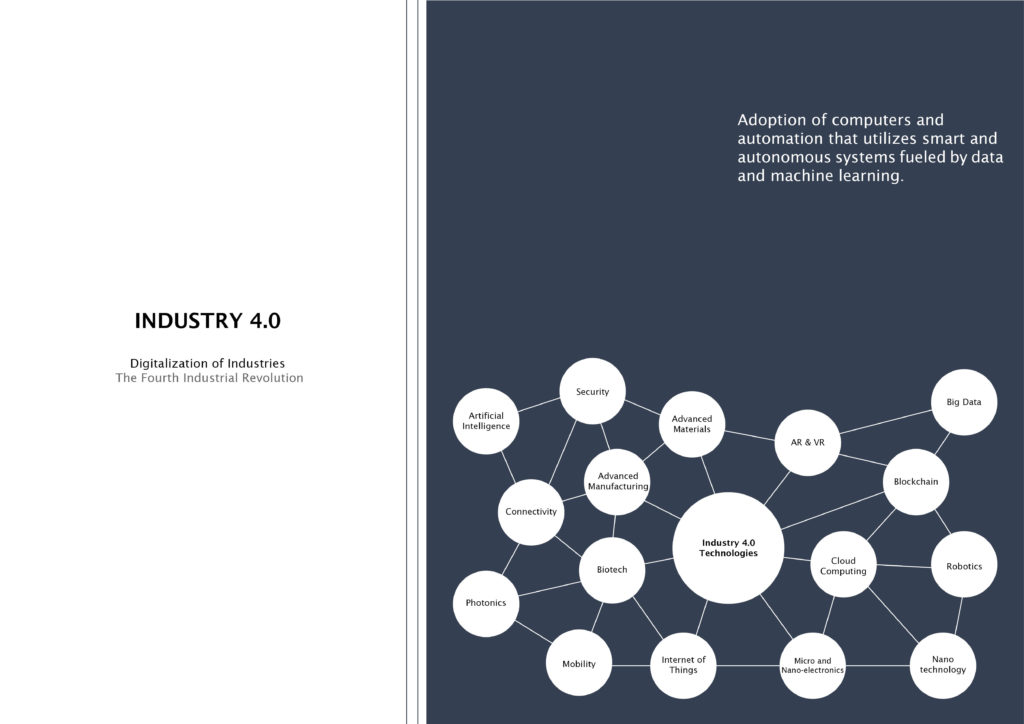

Advanced Industries

Advanced industries are characterized by their use of innovative technologies and represent the prime site in developed economies for the conversion of technical invention to enterprises

Can geographical proximity boost technology transfer?

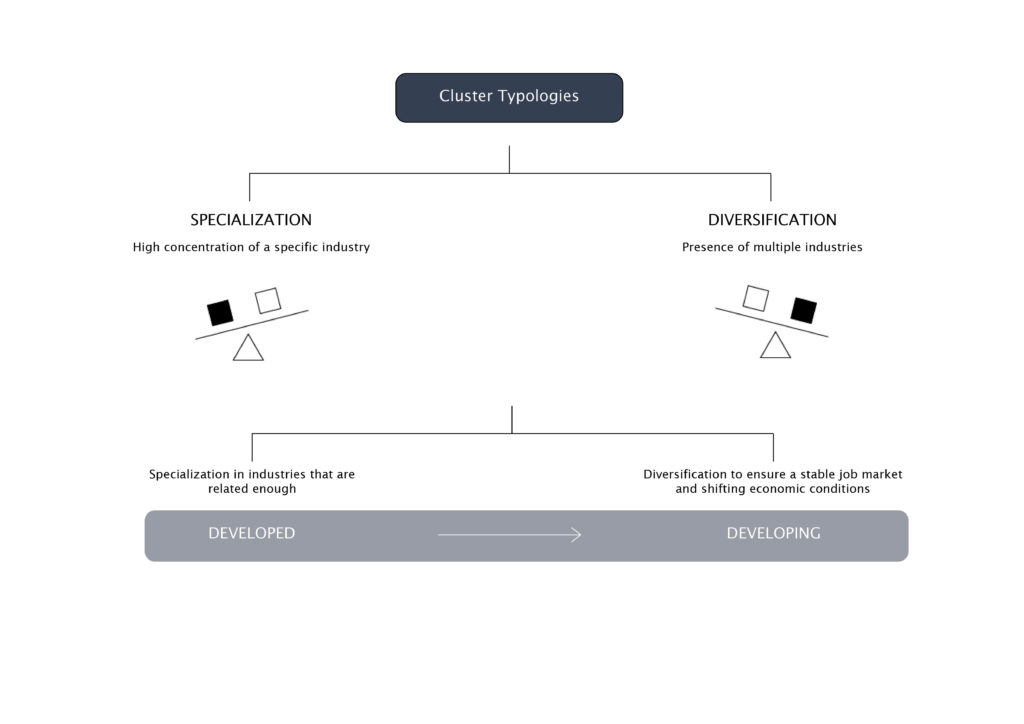

Industrial clusters are geographic concentrations of interconnected companies, specialized suppliers, service providers, firms in related industries, and associated institutions in particular fields that compete but also cooperate

Innovation Ecosystem

Multiple and interconnected actors – governments, civil society, the private sector, universities, individual entrepreneurs and others working together effectively.

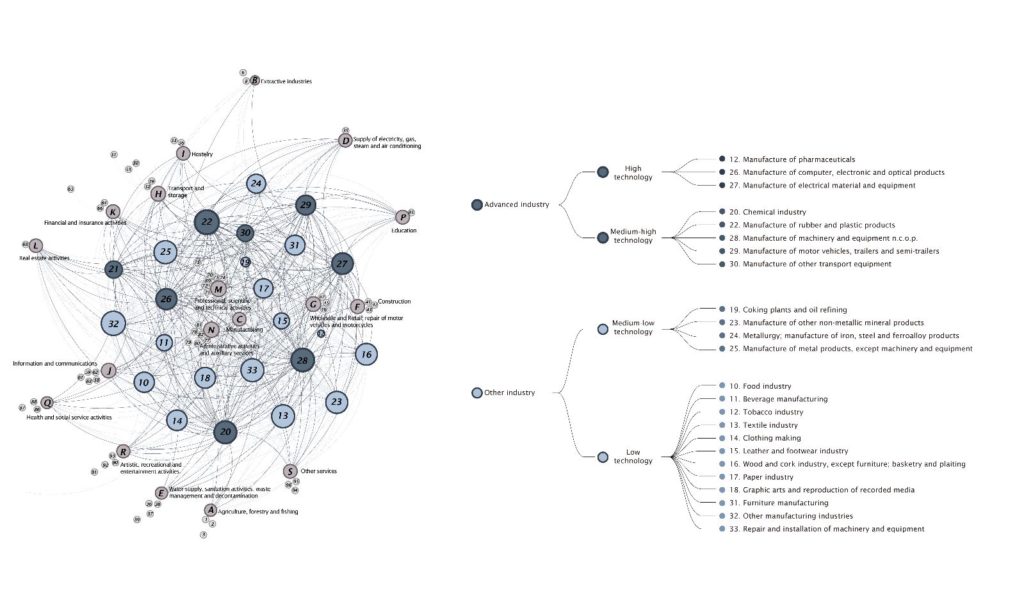

Industry Relatedness

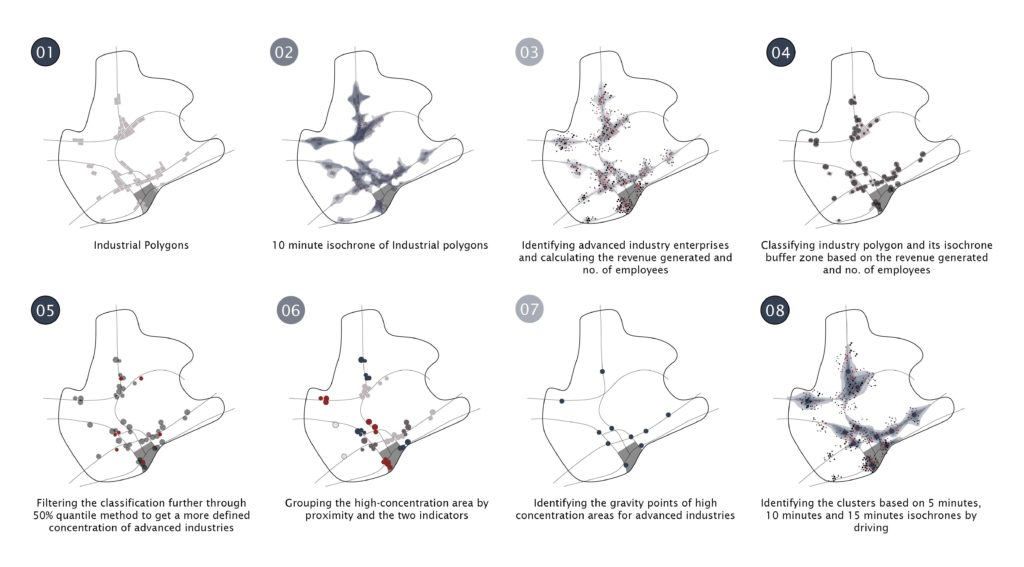

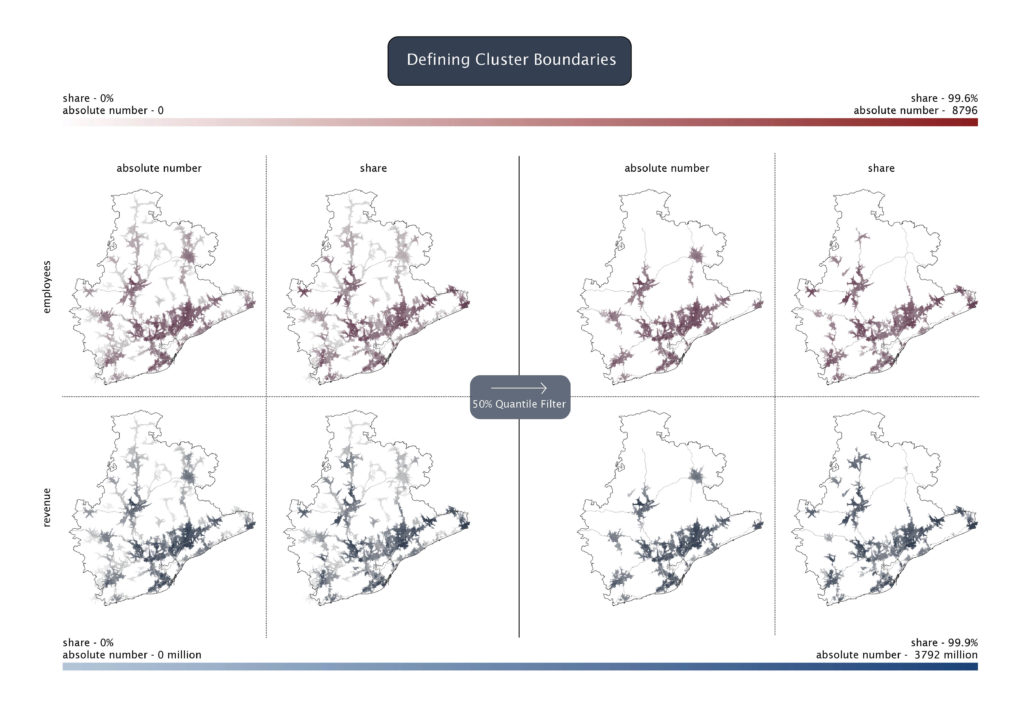

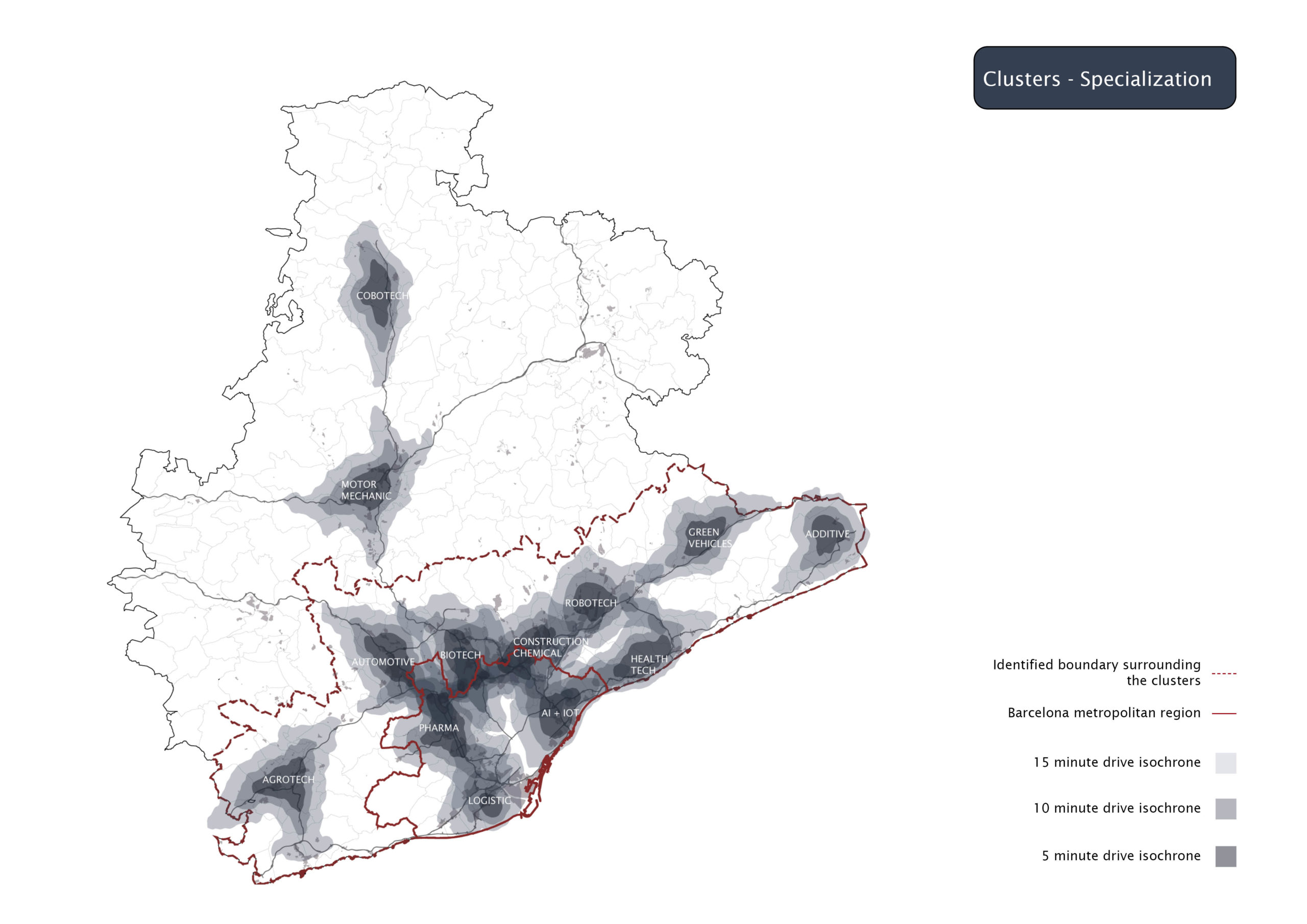

Our analysis began with demarcating a 10 minute isochrone around the industrial polygons and classifying the advanced industries based on two indicators – revenue generated and no. of employees.

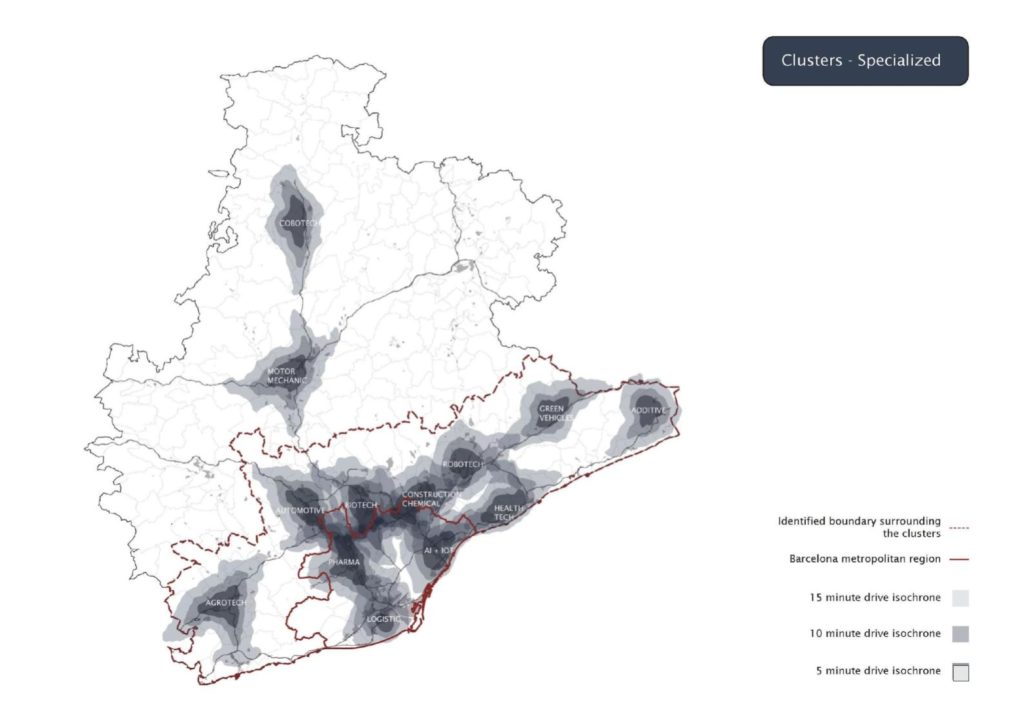

Thus, Zona Franca and Castelldefels have to be more focused on logistics, El Papiol and Hospitalet de Llobregat on the pharmaceutical industry, Martorell on automotive, Terrassa – Sant Cugat and Ruby on biotech, Montcada i Reixac and Cerdanyola del Valles on chemical industries, Barcelona Poblenou and Badalona fon AI and IoT, Villafranca del Penedes on agrotech, Manresa on mechanical engineering industry, Berga and Gironella on collaborative robotics, Granollers on industrial robotics, Mataro and Masnou on health tech, Sant Celoni on green vehicles, Malgrat de Mar and Tordera on additive manufacturing.

In addition, we have to mention that the specialization could change depending on the market demand.

Considering the EU’s strengths in advanced technologies on the global level, analyzed patterns of specialization of advanced industries and distribution of advanced technologies throughout Barcelona province, we have figured out thirteen clusters of advanced industries and their specialization regarding cluster policy focus. Overlapping clusters combine the metropolitan region of Barcelona with 160 municipalities which differs from the existing area of the Metropolitan Council which includes 33 municipalities.

Applying 5, 10 and 15 isochrones by drive we evaluated clusters’ proximity that foresee development of cluster policies in time.

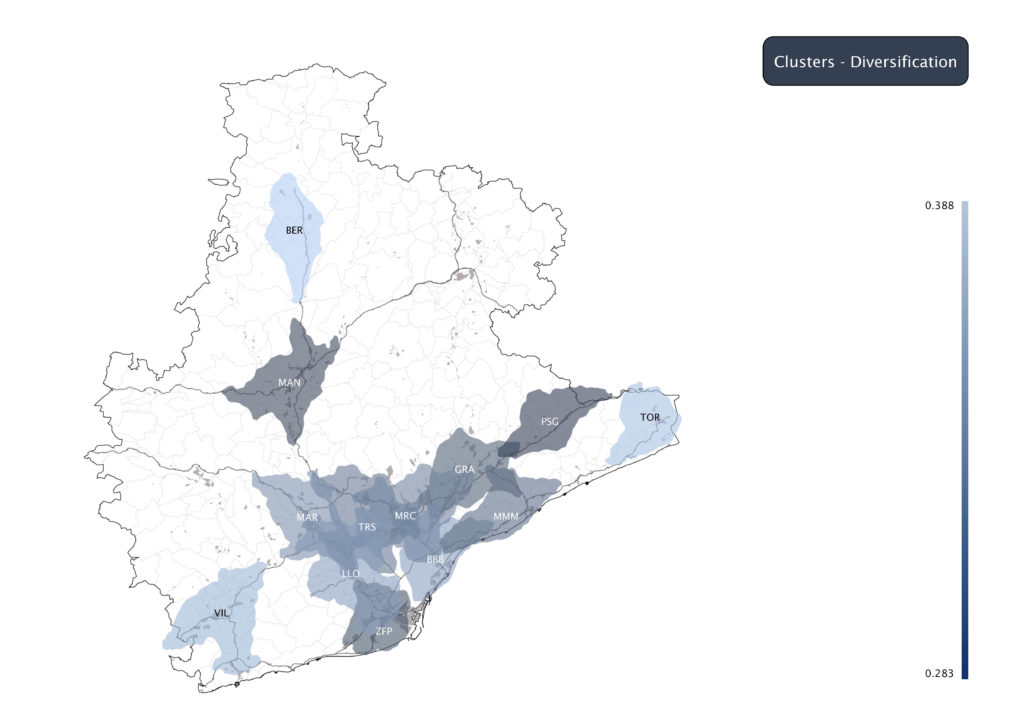

Multilateral analysis of clusters has unveiled patterns of their competitiveness and advancity.

We have analyzed amount of all industrial enterprises and advanced enterprises separately, their revenues and amount of employees, ratios between advanced and all industries, proximity of rnd centers and companies, startups and companies dealing with advanced technologies.

Five clusters around Barcelona, which are directly linked to highways, railroads, and the port, represent the strongest interconnection and industrial potential.

Another five clusters from the metro region area are characterized by the quite weak representation of RD component and less amount of advanced technologies.

And the last three remote clusters have a few enterprises dealing with advanced technologies and no RD centers.

Co-location analysis of clusters proved that the majority of innovative enterprises engaged with development of advanced technologies like robotics, IoT, AI, cloud tech, additive manufacturing, and circular tech are concentrated within identified clusters.

Consequently, we categorized them into three types: well-developed, high-potential, and emergent.

But what does clustering entail?

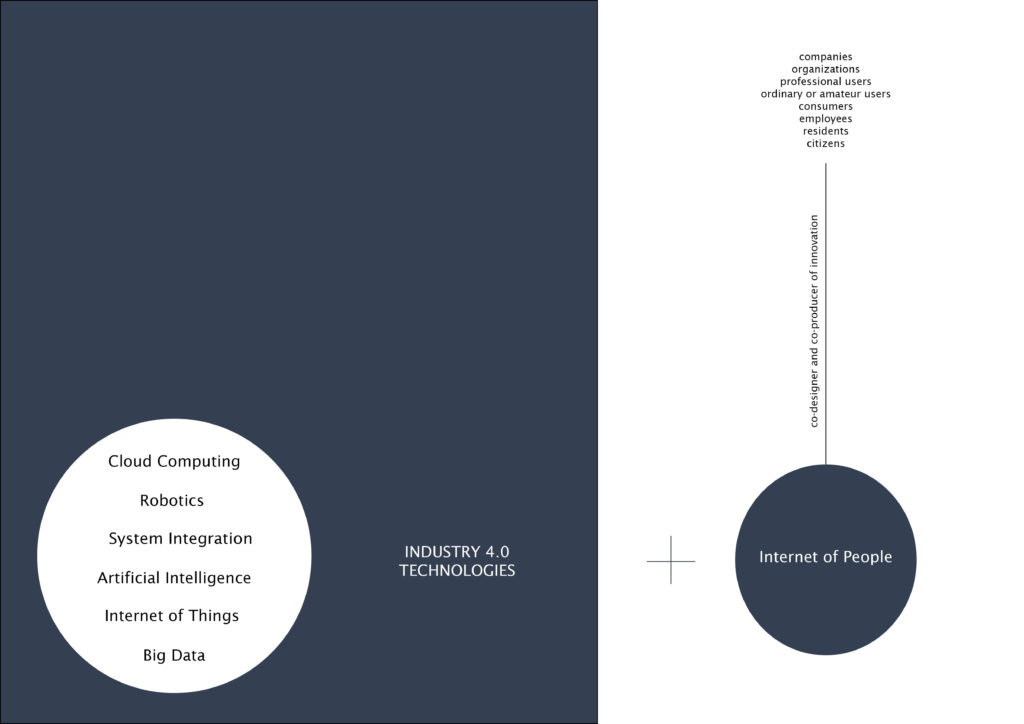

Clustering of advanced industries entails the core concept of development of a dynamic innovation ecosystem that continuously responds and modifies itself according to the emerging needs.

Quadruple helix model, uniting universities, public authorities and business, is intended to become the core concept of the dynamic growth of clusters.

Thus, with the help of the quadruple helix model, and engaging all types of end users of products and services, we introduce the internet of people to industry 4.0 aiming to facilitate technology transfer.

Following, we propose a user-driven tech transfer lab to participate with RD centers and small and medium enterprises and to contribute to the improvement of business models.

However, the tech transfer lab is only one tool from the scope of the policy proposal. In the general sense, the policy proposal considers all governmental actions in collaboration with other public and private institutions, which are targeted towards cluster formation and/or development and efficiency strengthening, that have to be uniquely tailored to each case.

We envision a policy-making process containing 7 phases: start of the discussion, economic and policy analysis, policy development, its implementation, monitoring and further adaptation to changes.

Alongside the lab, our focus on policy tools includes the introduction of more startup, innovation and accelerator hubs, especially in the areas where they are absent today, and the spread of industrial coworkings. And considering that mission-oriented public investment is vital to spur a revival of public-private investment, we propose tailored funding programs as crucial for the cluster policy.

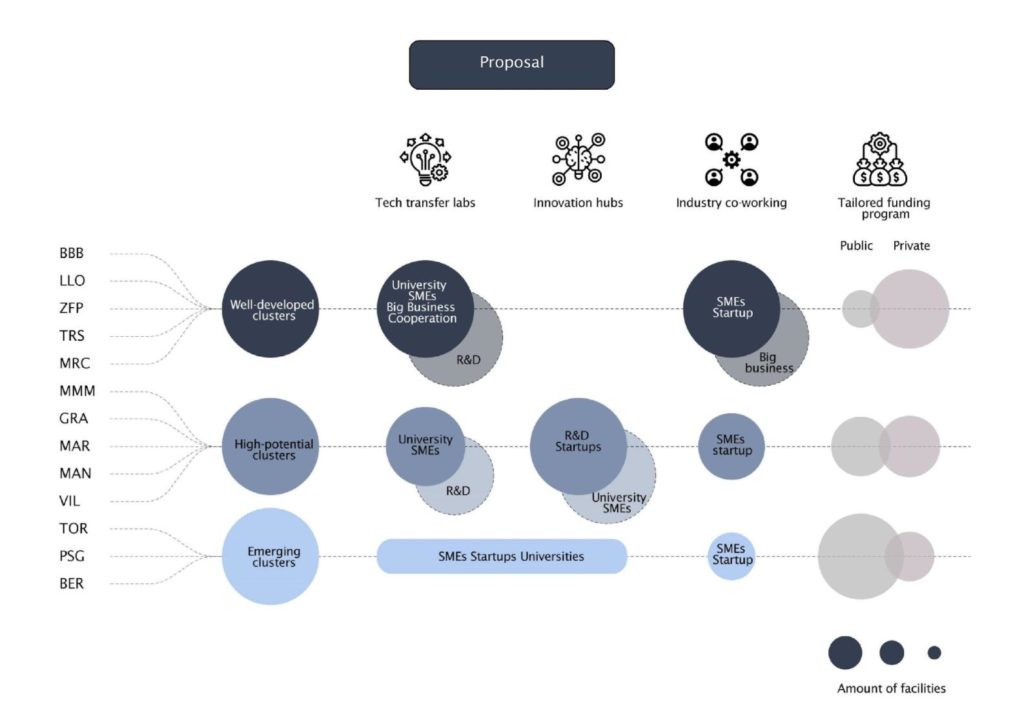

Going beyond, we propose the tailored cluster policy approach to the earlier identified cluster categories. Tech transfer labs are proposed in all cluster categories, and in the case of an emergent category of clusters they can be united with innovation hubs in single units. Considering the sufficient presence of startup hubs in the well-developed clusters, new innovation hubs seem more relevant as separate entities for high-potential clusters. Industrial coworkings would be a beneficial option for all cluster categories.

All policy tools have to consider their correlation with the number of advanced enterprises within each cluster.

Funding policy proposes the different split of shares from less to more-developed clusters, following the principle that less-developed ones need more public support.

Deepening the tailored approach we propose to consider strong and weak attitudes to policy tools by each stakeholder category where we can distinguish startups, small and medium business, big business, RnD centers and universities. So, apparently, the strongest attitude for all policy tools is expected from small and medium business, involving universities and RnD centers to the development of tech transfer labs and innovation labs.

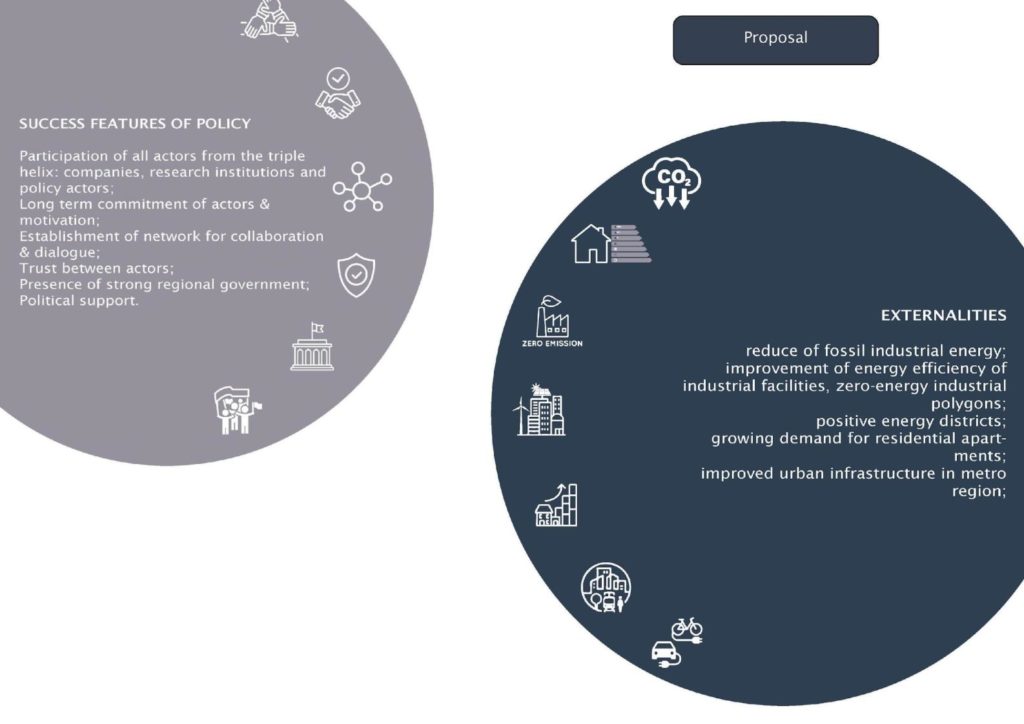

Success features of policy have to include: the participation of all actors, long-term commitment, the establishment of network collaboration, trust between actors, the presence of strong regional government and political support.

As positive externalities we expect the reduction of fossil industrial energy, improvement of energy efficiency, zero-energy industrial polygons; positive energy districts; growing demand for residential apartments; improved urban infrastructure in metro region; and accelerated transition to green transportation.

Geographical proximity has proven to be beneficial for technology transfer. This analysis revealed the tremendous potential of the identified industrial clusters and the proposal aims to categorize them and provide a policy framework unique to each.

References

- Advanced Manufacturing in Barcelona report

- European industrial strategy

- Metropolitan areas in the world. Delineation and population trends. AnaI.Moreno-Monroy, MarcelloSchiavina, PaoloVeneri.

- Definition matters. Metropolitan areas and agglomeration economies in a large-developing country. Bosker, Maarten

- The pan-European population distribution across consistently defined functional urban areas. Schmidheiny, Kurt.

- Urban growth and transportation. Duranton, Gilles.

- Ley 14/2018, de 5 de junio, de gestión, modernización y promoción de las áreas industriales de la Comunitat Valenciana. (Titulo 12) – https://www.boe.es/buscar/doc.php?id=BOE-A-2018-8949

- Recovery plan Next Generation EU – https://next-generation-eu.europa.eu/index_en

- Recovery, Transformation and Resilience Plan of Spain – https://www.mincotur.gob.es/en-us/recuperacion-transformacion-resiliencia/paginas/plan-recuperacion-transformacion-resiliencia.aspx

- Startup law Spain – Ley 28/2022, de 21 de diciembre, de fomento del ecosistema de las empresas emergentes. https://www.boe.es/diario_boe/txt.php?id=BOE-A-2022-21739

- Roadmap for the Circular Economy in Catalonia 2021-2027 – https://projects2014-2020.interregeurope.eu/fileadmin/user_upload/tx_tevprojects/library/file_1655473320.pdf

- Listado completo de actividades de la CNAE 2009 – https://www.cnae.com.es/lista-actividades.php

- Ley 15/2020, de 22 de diciembre, de las áreas de promoción económica urbana de la Comunidad Autónoma Cataluña. https://www.boe.es/buscar/pdf/2021/BOE-A-2021-462-consolidado.pdf

- Catalonia 2020 Strategy – http://catalunya2020.gencat.cat/web/.content/00_catalunya2020/Documents/angles/fitxers/ecat2020_en.pdf

- The strength of an innovative and outward-looking nation. Catalan Economy. Report by generalitat Catalunya.

- The artificial intelligence in Catalonia: Technology report by ACCIO

- Asia Strategy of barcelona City Council – https://ajuntament.barcelona.cat/relacionsinternacionalsicooperacio/sites/default/files/estrategiaasia_en.pdf

- Climate Plan 2018-2030 of Barcelona

- NewSpace Strategy of Catalonia

- Advanced Manufacturing in Barcelona. Report

- Atlas of Innovation districts. Aretian. https://www.aretian.com/atlas

- Metroverse The Growth Lab’s Urban Economy Navigator – https://metroverse.cid.harvard.edu/

- El Compromiso Metropolitano 2030 https://pemb.cat/es/barcelona-dema/

- Global Friction Surface 2019 – https://developers.google.com/earth-engine/datasets/catalog/Oxford_MAP_friction_surface_2019

- Copernicus CORINE Land Cover CLC 2018 – https://developers.google.com/earth-engine/datasets/catalog/COPERNICUS_CORINE_V20_100m

- GeoMining technology. Iacopo Neri – https://github.com/neriiacopo/GeoMining-EE-Hops

- Edward W. Hill and John F. BrennanView all authors and affiliations. Volume 14, Issue 1 https://doi.org/10.1177/089124240001400109. A Methodology for Identifying the Drivers of Industrial Clusters: The Foundation of Regional Competitive Advantage