Using Street View and Remote Sensing to Assess Risk and Empower Small Businesses

Whos got my Credit?

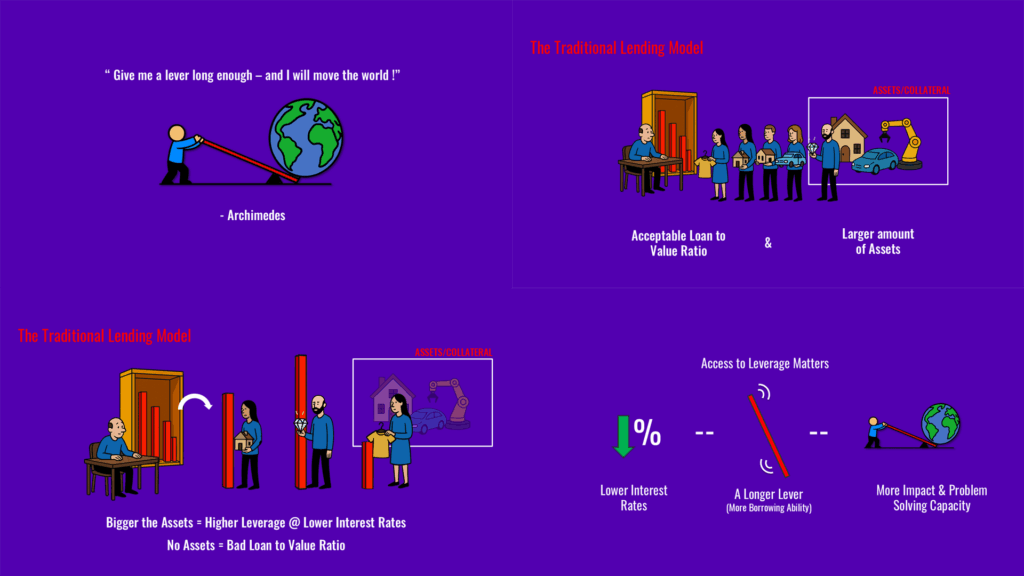

Access to credit is a fundamental driver of economic growth, especially for Micro, Small, and Medium Enterprises (MSMEs) in the Food & Beverage (F&B) sector. Yet, traditional lending models—rooted in asset-based evaluations—often exclude countless small business owners, particularly in rapidly urbanizing economies like India. This post explores how novel data sources and innovative analytics can reshape credit assessment, unlocking opportunities for financial inclusion and sustainable urban development.

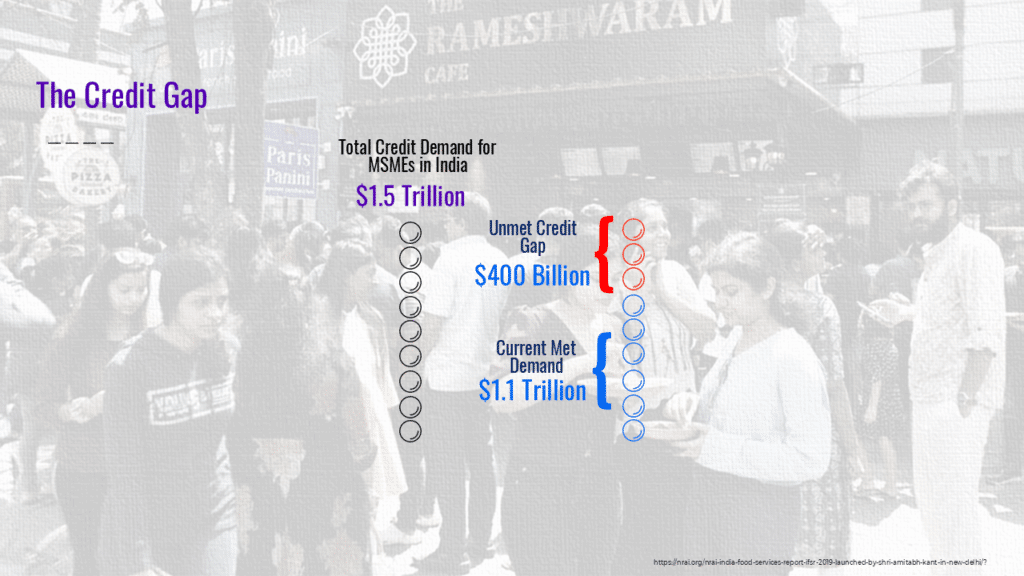

The Challenge: The Credit Gap for MSMEs

MSMEs represent the backbone of India’s economy, accounting for 99% of businesses. However, a significant share of F&B establishments—65%—operates informally, making them invisible to traditional lenders. These businesses lack the collateral, formal documentation, or credit history required by conventional banks, resulting in a persistent gap between credit demand and supply.

Traditional lending relies on financial statements, credit history, and collateral. The more assets an applicant has, the more likely they are to secure a loan at favorable rates. But this model leaves behind countless entrepreneurs who, despite strong business potential, lack formal documentation.

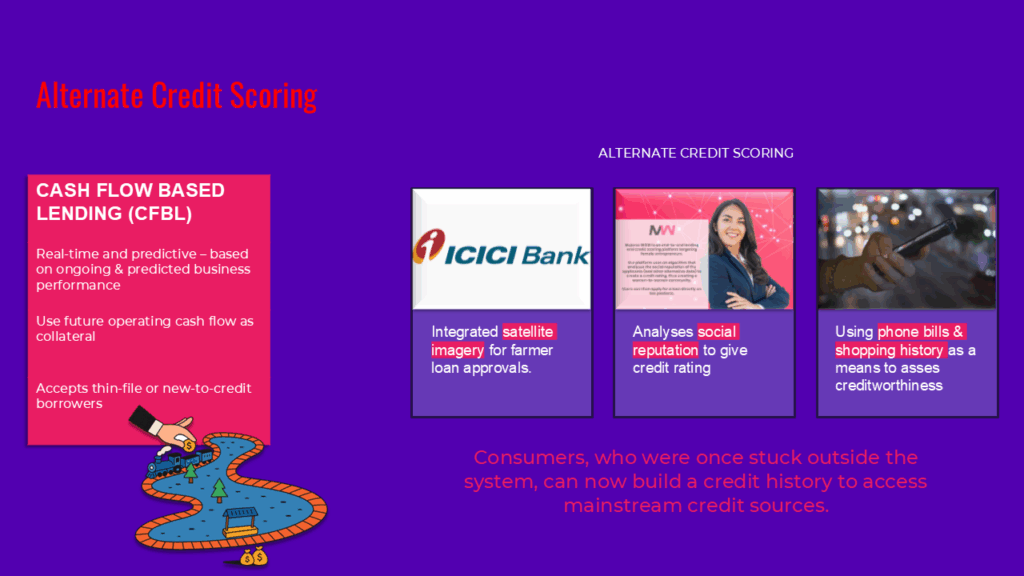

Emerging models, such as cash flow–based lending, shift the focus to real-time and predicted business performance. This approach is especially relevant in developing economies, where rapid growth coexists with large informal sectors. However, cash flow–based lending requires new data sources to accurately assess creditworthiness.

Harnessing the Build Environment as an Input.

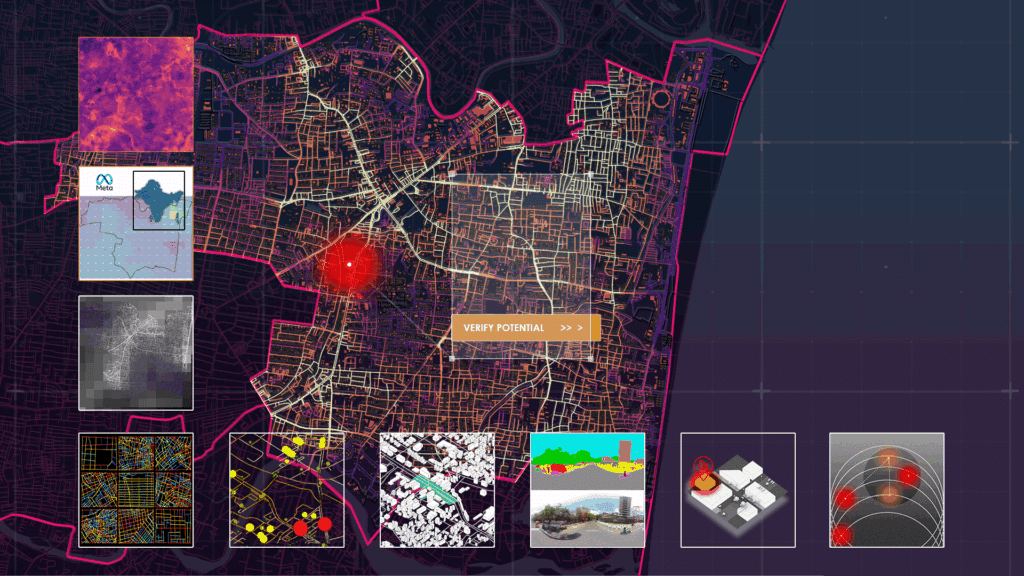

Recent advances in remote sensing, computer vision, and geospatial analytics have opened new frontiers for credit assessment. Satellite imagery and Street View data provide rich, scalable sources of information about the built environment, enabling the quantification of factors such as population density, thermal comfort, socio-economic context, and urban morphology. By integrating these datasets, it is possible to construct composite metrics that capture the “business-location fit” of individual establishments—a concept that goes beyond traditional financial indicators to reflect the unique advantages and constraints of specific urban locations.

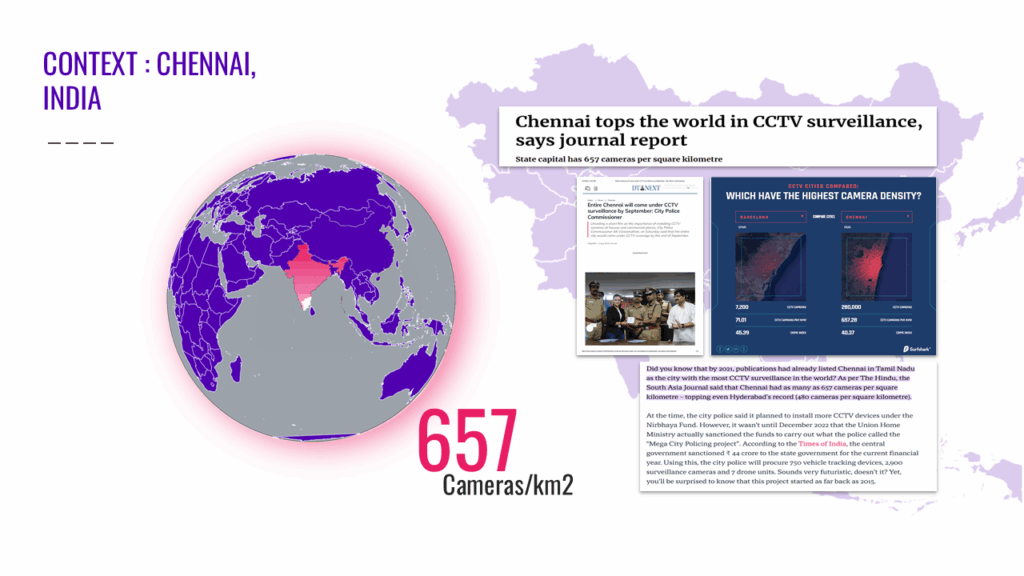

Geolocating the Development of this Tool : Chennai, India

Chennai presents both opportunities and challenges as a test bed for studying the impact of F&B establishments and the significance of geolocation factors on their success. The city holds the 4th largest food service market in India, valued at ₹15.6 thousand crores ($18.72 billion USD), with Quick Service Restaurants (QSRs) and cloud kitchens leading the organized segment. Its diverse population, rich culinary heritage, and growing appetite for experiential dining make it an ideal location to test innovative F&B formats. Areas like Anna Nagar exemplify culinary booms, offering insights into how geolocation factors like footfall, accessibility, and neighborhood demographics influence restaurant success. Additionally, Chennai’s established legacy chains and multi-brand restaurant models provide a robust framework for analyzing scalability and customer loyalty.

The Methodology

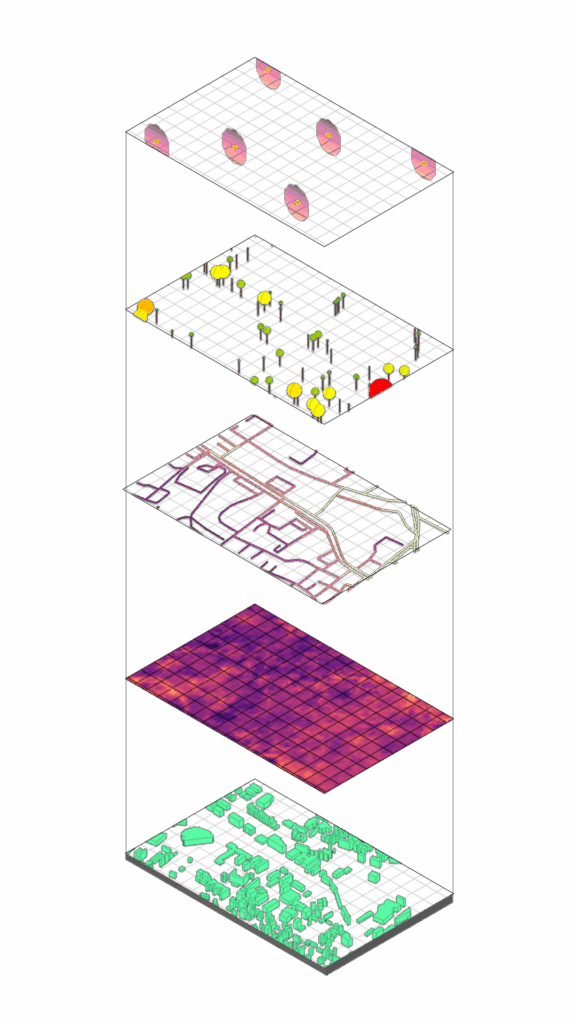

The project began by collecting data from open sources such as OpenStreetMap, Google Earth Engine, and Overture Maps. The goal was to identify universal parameters that signal the viability of a location for F&B businesses.

Key steps included:

- Satellite Data Analysis: Assessing thermal comfort, socio-economic indicators, and population density.

- Street View Imagery: Using computer vision to evaluate visual appeal, storefront visibility, and environmental factors such as pavement quality, canopy coverage, and street furniture.

- Environmental Systems: Measuring centrality, competition, and proximity to points of interest within walking distance.

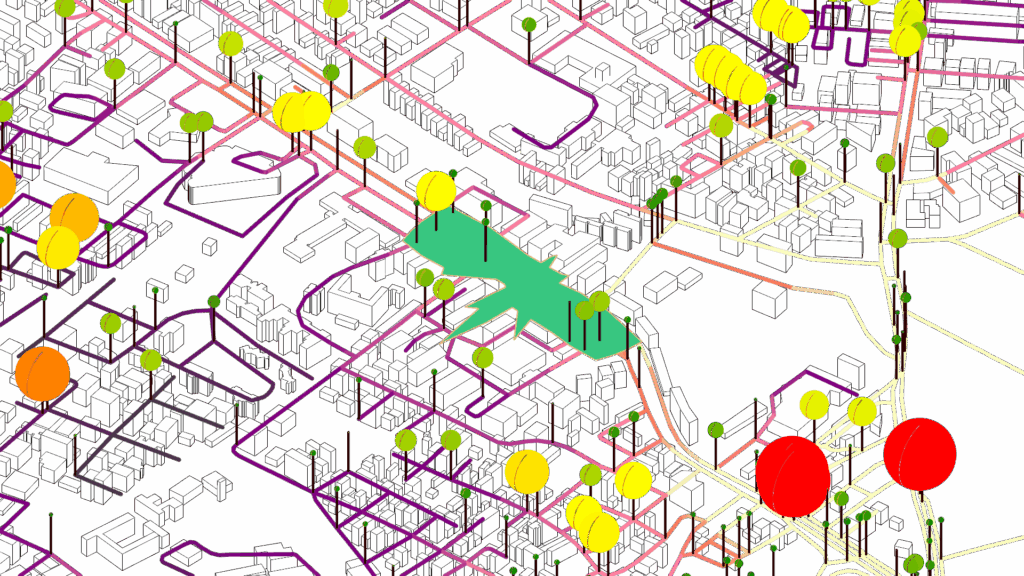

A deep learning model processed over 4,000 street-level photos, performing image segmentation and object classification to quantify elements that contribute to a location’s attractiveness. Parameters were assessed at the street segment level, providing hyper-local insights for lenders.

From Theory to Practice

While the methodology is broadly applicable, its implementation is illustrated through a detailed case study in an urban neighborhood. Here, the tool identifies clusters of successful F&B establishments and distills the key spatial and environmental factors that contribute to their viability. This analysis not only informs credit assessment but also provides urban planners and policymakers with valuable insights into the drivers of local economic activity.

Implications and Future Directions

The integration of spatial data and computer vision into credit assessment has far-reaching implications:

- For Lenders: Enhanced ability to identify viable business opportunities, reduce risk, and expand access to credit for underserved populations.

- For Urban Planners and Policymakers: New tools for understanding hyper-local economic dynamics, supporting evidence-based interventions, and fostering sustainable urban development.

- For MSMEs: Greater access to financial resources, empowering entrepreneurs to invest in growth and resilience.

Looking ahead, the next phase of research will focus on refining the machine learning models, incorporating agent-based simulations for temporal analysis, and expanding the scope of data integration to include emerging sensor networks and alternative data streams. This ongoing innovation promises to further democratize access to credit and support the development of more inclusive, resilient urban economies.

Conclusion

By bridging the gap between traditional financial systems and the realities of urban informality, spatial data and computer vision offer a powerful lever for advancing financial inclusion. As cities continue to evolve, the integration of these technologies into lending practices will be essential for unlocking the full potential of urban MSMEs and building more equitable, sustainable urban futures12.

This approach reflects the analytical rigor and interdisciplinary perspective of urban planning, economics, GIS science, and research, while addressing both the technical and policy dimensions of financial inclusion.