The project envisions the use of novel data collection strategies for the purpose of increasing access to formal credit for MSMEs in the F&B Space

Across the globe, cities face a pivotal challenge: unlocking the potential of their micro, small, and medium enterprises (MSMEs) to drive both urban transformation and national economic growth. These enterprises, often comprising over 90% of businesses in developing economies, act as the backbone of urban economies, creating jobs, enhancing local supply chains, and fostering innovation. However, their influence extends beyond economic metrics.

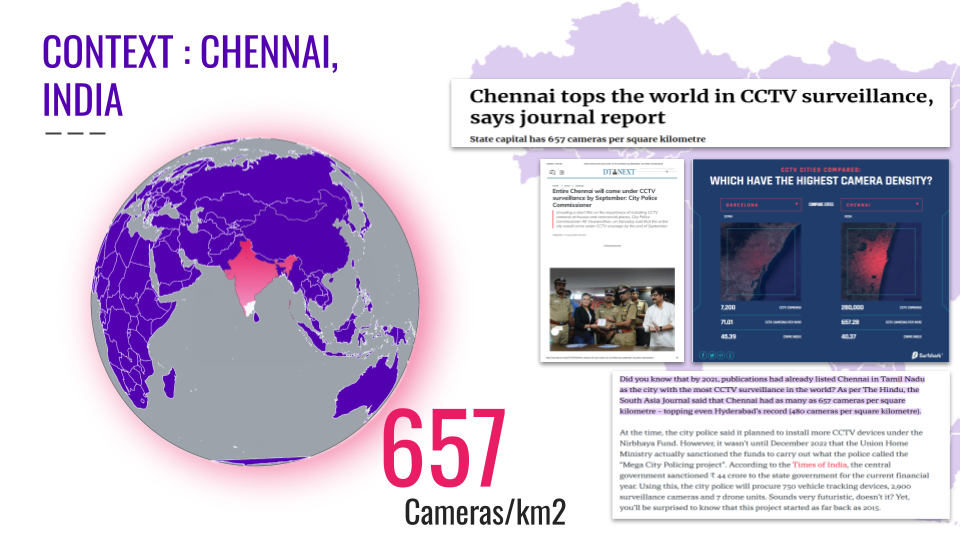

The World Bank emphasizes the importance of cities and its enterprises achieving creditworthiness as a foundation for unlocking long-term private investments in infrastructure projects. “Supporting cities on the path to creditworthiness is the crucial first step in unlocking larger, longer-term investments,” the institution notes. By improving credit systems and leveraging urban data from smart city technologies, cities can enhance governance, provide essential services, and attract investments that foster sustainable growth.

The intersection of financial innovation, urban governance, and smart city technology could be the key to addressing credit gaps while paving the way for robust urban development. The question remains: How can we empower cities and MSMEs alike to leverage this data towards equitable financial access and sustainable urban development outcomes?

LEVERAGING PHYSICAL INFRASTRUCTURE & COMPUTER VISON TO CREATE A COMPOSITE SCORING METRIC TO SUPPLEMENT CREDIT SCORING FOR MICRO,MEDIUM & SMALL ENTERPRISES (MSMEs) IN THE F&B SPACE.

Leveraging technology to create societal impact is not just an opportunity—it is a responsibility. In the context of micro, small, and medium enterprises (MSMEs), empowering this backbone of urban economies through innovative platforms can drive sustainable development. By harnessing advanced data capture methods, such as IoT devices and geospatial tools, governments and private entities can build inclusive credit systems that provide visibility and access for underserved businesses.